Russia is in the possession of enormous store of hydrocarbon reserves: which are estimated at 14.47 trillion m3 for gas, and 9.04 billion tons – for oil. However, extraction of such reserves is becoming increasingly difficult. There is a growing interest in extraction of high-viscosity oil, while, the profitability of production still decreases. The problem of reducing profitability for depleted wells is particularly challenging. What is the actual state of the well stock today, which is the period between overhauls (turnaround time) for well operation, how will the market for mechanized production change in the coming years and which are the main factors affecting oil production in Russia? These and other issues were discussed by leading industry experts at the 16th International Practical Conference "Mechanized Oil Production-2019"

State support

Russia is the concentration of the largest oil reserves, its production is growing in excess of the tolerated threshold of 550 million tons. This is made possible now due to the measures to stimulate the oil industry, which have been undertaken in recent years by the government – said Andrei Vasilyevich Tereshok, the Deputy Director of Oil and Gas Production and Transportation Department of the Ministry of Energy of Russia, who spoke about the main trends in the oil and gas industry and measures of state support for the production of high-capacity mining.

Among the main measures of state stimulation of oil production, the speaker noted a number of initiatives undertaken: measures to support production in Eastern Siberia, remissions in natural resources production tax, export duties, a unique tax regime for offshore fields with liberal rates, and a system to support the production of unconventional oil.

Recently, the state in particularly stimulates geological exploration. A special income tax coefficient was introduced for costs associated with geological exploration on the continental shelf as part of support, (in the future it is planned to extend this measure to on-shore deposits) and to increase the coefficient within the continental shelf, since the current level of coefficient is relatively low and does not create enough incentives – as it was noted by A. Tereshok.

The speaker put emphasis upon the road map, which was adopted in order to stimulate oil production at the end of 2018, comprising the several sections: the first one is based on a physical verification of all major fields with a total volume of reserves, exceeding 5 million tons in terms of the economic profitability. The work should be completed by the summer of this year, there will be obtained a list of all the main targets for exploitation and given assessment of their economic profitability based on the results of inventory. At the second stage, specific tax tools will be selected to maximize the difference between the technologically achievable and economically sound profile. There will be also held a job related to the support of oil production in Western Siberia. Today everyone is talking about the low profitability of development in that region, but only few people pay attention to the main advantage, which is a developed infrastructure in the oil production location. The regional reserves are rather considerable, but the need for additional drilling concurrent with current tax environment is low, hence the creation of additional incentives will upscale the production and increase the level of investment.

Speaking about the prospects, A. Tereshok has emphasized that work for raising incentives for geological exploration will be continued, with a discussion of problem of expanding the scope of Excess-Profits Tax. In addition, it is planned to create a more equitable system of tax incentives for Eastern Siberia. At present, the Mineral Extraction Tax (MET) privilege for the region is calculated from the date of license issuance – which is unfair, as minimum 4 or 7 years are required from the moment of obtaining the licenses to the actual commissioning of a field to industrial development. Accordingly, the effective period of tax privilege is lost and, in fact, when it comes to the commercial production, the company loses any MET exemption by the moment the field is being drilled. The speaker noted that the Ministry is planning to make changes to the Tax Code for the dates of reference in terms of Mineral Extraction Tax redemptions for the new production regions begin from the moment of actual industrial production, i.e. from one percent of depletion, as has already been done for some offshore fields.

Separately, there was noted the need to create incentives for application of enhanced oil recovery techniques. The use of enhanced oil recovery techniques (EORT) dramatically increases the cost, especially at the initial stage, until the technology has not been well developed. Their further replication should be linked to the provision of certain tax remissions. The administration scheme is not yet thoroughly apprehended, but the key point is that all additional mining, base upon these methods, should be taxed at a reduced MET rate.

Separately focusing on stimulating production at small fields, the speaker has identified two problems. First, the tax concessions for deposits with the reserves of less than 5 million tons is currently included in the Tax Code. However 5 million tons are determined by a specific date, therefore there are some deposits that fall out this benefit. Secondly, deposits of 10 and 15 million tons of the initially recoverable reserves can be attributed to the small ones.

The speech has raised many questions. Chairman of the Expert Council for Mechanized Oil Production, R.S. Kamaletdinov, became interested in indicators of specific energy consumption by oil companies and asked to clarify the opportunity to expand the list of reports of the Central Control Administration of Fuel and Energy Complex (CCA FEC).

Mr. Tereshok promised in case of request, this question will be worked out, making a reservation that the main source of information – is oil companies, therefore it is impossible to give a clear answer about the availability of such reports, frequency of reporting and about the level of detailization.

Other participants in the discussion were more interested in government support measures. Tarasov Maxim Anatolyevich, head of the Surgutneftegaz production department, asked the speaker to clarify the issue of benefits related to the production of high-viscosity oil: “We plan to start the Timan-Pechora province mining, where there are complicating factors – highly viscous oils. Do you plan to introduce any benefits, because mining at the moment is not profitable there?”

- For highly viscous oils, there are concessions for mineral extraction tax, deduction for export duties for oil with viscosity above 10,000 MPa. As a part of our work, these deposits will get into the inventory period.

There were questions regarding whether the government’s policy towards shale oil production would change?

- high-capacity oil resources is partly similar to shale oil. There are benefits for MET – they are sufficiently large – from zero rate to 20%. The issue of developing the Bazhenov formation is relevant for a number of regions and the solution is related to field test sites where technologies can be worked out properly.

Well stock

Questions associated with the production of high-capacity oil are in concern not only in terms of the benefits provided for their development. Today, one of the main trends in the oil industry is reduction in share of high-quality reserves according to ABC 1 categories, two thirds of which, precisely, 12 billion tons, are classified as high-capacity oil, Rustam Sagaryarovich Kamaletdinov has stated in his report on the main indicators of mechanized well stock. Among other trends, he noted the dominance of state-owned oil companies in the structure of oil production, low growth in proven reserves due to reduced investment in exploration, consolidation of the oilfield services industry and, of course, in active introduction of digital technologies.

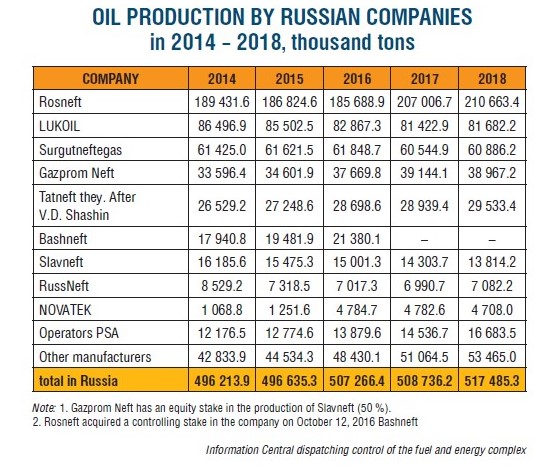

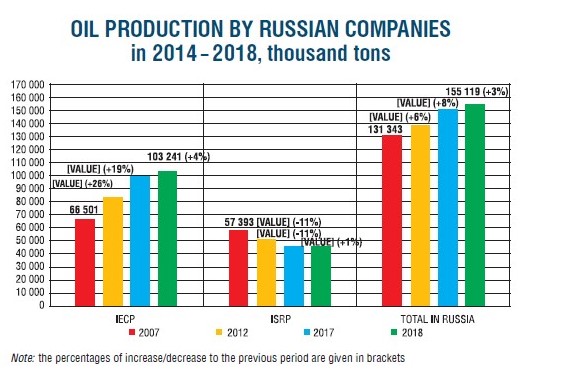

Since 2007, oil production in Russia has increased to 517 million 483 thousand tons. Over the past year, the increase was by 1.7%. An increase in oil production over the past 5 years has been achieved by Rosneft, Gazpromneft, Tatneft and Bashneft. Over the past 5 years,Lukoil, Surgetenftegaz, Slavneft, and Rusneft companies have reduced the production of liquid hydrocarbons.

The total stock of wells providing products has increased by 18% over the past 11 years.

The speaker cited interesting data, concerning the Oil-well fund.

Thus, the number of wells equipped with ESP has increased by 55% in 11 years. The producing wells stock with sucker-rod pumping units (SRPU) was amounted to 57393 wells at the beginning of 2008. If 10 years ago, SRPU was accounted for 51% of the stock, now this figure has grown up to 67%. This long-term trend is caused by the need to ensure the maximum well sampling. Today, the SRPU plants produce 81% of the oil from cumulative oil production.

Considering the well stock, producing oil for the large oil companies at the beginning of the current year, the speaker noted that the producing wells stock, equipped with SRPU in Rosneft at the beginning of the year, was 38,303 or 37%. According to Surgetneftegaz – 25,626 wells or 20%, PJSC Lukoil – 19,499 19%, Gazpromneft – 7,350 (7%), Tatneft – 4,285, Slavneft – 3,687, Rusneft – 1,796 wells. Well stock equipped with SRPU: Tatneft – 15850 (35%), Rosneft – 14753 (32%), Lukoil – 7214 (16%), Surgutneftegaz – 1446 (3%).

R. Kamaletdinov has considered the questions of the overhaul period of wells operation of the entire oil fund with a division into electrical submersible pump units (ESPU) and SRPU. The turnaround (time between overhauls) of the oil fund over the past 10 years has increased by 48%. The turnaround of the stock, equipped with ESPU units was increased by 49%, SRPU – by 59%.

Mentioning the companies that significantly increased the long-term industrial activity of wells, equipment throughout the fund over the past year, the speaker noted that last year Gazpromneft has achieved the largest increase – 15%, Rusneft – 13% and Tatneft – 10%. In general, the increase in the entire well stock was 6%. The highest ESPU turnaround by January 1, 2019 was reached in Surgetneftegaz – 1122 days, then Bashneft – 962 days, Gazpromneft – 889 days, Slavneft – 848, Rosneft – 795, Lukoil – 657 and Rusneft – 704.

The turnaround for ESPU at the beginning of the year, reached by Bashneft – 1126 days, then Tatneft – 1109, Lukoil – 813, Rosneft – 747, Surgutneftegaz – 525, Rusneft – 469 and Slavneft – 247 days.

Considering the world production market, the speaker analyzed the dynamics of its segments. Thus, in 2007, the total global service market was $276 billion. In 2008, it has reached $324 billion. During the crisis, there is a decrease of 16%, after which there is a significant increase to 464 billion in 2014. The crisis in 2015 leads to a fall by 28% (to 336 billion), the following year the decline continued and reached 33%, in 2017 there was a growth by 5% compared to 2016, and in 2018 – an increase by 10%.

Mentioning that in 2009 the Russian service market occupied 5% of the global volume, R. Kamaletdinov focused on the segment of mechanized mining in more detail. In 2007, the market amounted to 6 billion 240 million USD, in 2008 it grew up by 23%, reaching the maximum in 2014 and being estimated at 15 billion 293 million USD, upon which it went down in 2015 with 27%, in 2016 fell lower by another 28%; in 2017 was an increase by 9%; and in 2018 – by 13% to 9 billion 920 million USD.

The speaker has noted an interesting fact: Today, three companies, Halliburton, Schlumberger and Baker Hughes, account for 58% of the market; their total revenues amount to $5.7 billion, but also, with a great pleasure, he emphasized that there are Russian companies: Borets and Novomet, which revenue last year amounted to $940 million (9.5% of the total world market).

Summing up, R. Kamaletdinov concludes that today it is possible to predict significant changes in the market of mechanized production for the coming years. However, for the unconditional implementation of the state strategy to develop the program of the fuel and energy complex of Russia, it is necessary to revise approaches to the regulation and functioning of the service market of artificial lift mining.

Equipment and Technologies

The reports of the second session were devoted to new technologies and equipment.

Vladislav Viktorovich Kirichenko, Head of the Central Escort Service of PJSC Surgutneftegaz, spoke about the operation of ESPU of the company's low-yield well stock. He noted that the annual growth of well stock, equipped with ESPU, is up to 4%, and the annual growth of the marginal fund – is up to 8%. As a solution for improvement of operating efficiency of the low-yield wells with ESPU, the speaker proposed the following: constructive improvement of equipment, organizational solutions and the search for alternative ESPU equipment.

In more detail, the speaker focused on the operation of the ESPU unit at the well stock of the Oktyabrsky District, where production is complicated by elevated reservoir temperature and intensive scaling. 100% completion by heat-resistant equipment and equipment with enhanced wear resistance was made in order to improve operational performance since 2015, which has formed a positive trend in non-failure operation time of ESPU systems.

Since 2017, the increased reliability equipment has been applied at other fields of the company's complicated well stock. The volume of implementation of equipment of increased reliability in 2018 reached 5480 units, depending on complicating factors, or about 12.5% of the annual volume of installations – said V. Kirichenko

He also noted that the company has an operation support service under the Central Production Service Base for (Rental and Repair of) Electric Submersible Installations (CPSB ESI), which controls the operation of the ESI, makes recommendations to the Oil-and-Gas Production Department (OGPD) services for current operation, analyzes the causes of failures and risks of complications during the operation of the ESPU, and also develops special ESPU configurations.

In the conditions of one hundred percent coverage of the mechanized well stock by a remote control system and remote control, the operating parameters of ESPU are monitored. Since 2017, the program "Identification of deviations in the work of the ESPU and the prediction of possible failures" has been put into commercial operation in the company. A timely response to changes in the operating conditions of the ESPU system helps to prevent equipment failure. In 2018, over 900 deviations were identified and eliminated at the well stock of more than 6000 wells, creating the risk of premature equipment failure.

About the results of work of JSC Zarubezhneft mechanized well stock for 2018

The Deputy Head of the Oil and Gas Production Department Salomov Iskander Pulatovich has stated the following.

Speaking about the performance of the mechanized well stock of LLC "IC Rusvietpetro", he noted that 46 failures of downhole pumping equipment (DPE) have occurred for the twelve months period by 01.01.2019. The main share of failures is attributable to a decrease in insulation resistance (R-0) and as a result of preventive maintenance for 14 failures. The increase in performance of preventive maintenance for geological and engineering operations is associated with the general aging of well stock, which average time is 2035 days. The main potential problem areas – is a struggle with complications: Asphaltene-resin-paraffin deposits, insufficient inflow, viscosity, scaling, as well as optimization of the setting depth of ESPU. Considering the indicators of "Zarubezhneft-Mining Kharyaga", the speaker has underlined that, in general, there is a decrease in the average bottomhole pressure and dynamic level, which are conditioned by the natural depletion of layers. For 2018, there is a positive trend in mechanized well stock performance, an indicator of the average runtime was met, which is associated with a decrease in the number of failures for the last twelve months. Analysis of the operation of the mechanized well stock of LLC "Zarubezhneft-Mining Samara" shows the stabilization of average oil and fluid flow rates, possible due to introduction of new wells No. 3P of the Pashkinsk field (JSC Orenburgnefteotdacha), No. 2R of the Nizhnemazinsk field (JSC Ulyanovskneftegaz).

Well operation conditions are characterized by low bottomhole pressures.

New Developments

The third session was devoted to new developments, which appeared in the equipment manufacturers. Representatives of leading industry participants have presented their new products. The head of the development department of JSC “RIMERA” Alexey Vladimirovich Trulev has delivered a report

about the experience of operating a new generation of hydroprotection with a dynamic maze. The head of the central engineering technology service of the Research and Production Company "Packer", Zmeu Artem Aleksandrovich spoke about the new technologies of RPC "Packer".

The session also included a report by the head of the bureau of the Innovation Development Department of Novomet-Perm JSC. Mikhail Vasilyevich Panachev, spoke about Novomet volumetric pumps for viscous oil production.

During the operation of the sucker rod pumping unit (SRPU), a number of problems and limitations should be taken into account, to which, first of all, high capital costs and a long period of development of a new well, complex installation of ground equipment, limited in depth of descent and curvature of the well, abrasion of tubing, restrictions on temperature and gas content. There is a need to select rubber materials and the gap between the rotor and the stator to a specific well fluid – said the speaker.

For the production of viscous oil, the company has developed a new design of a volumetric pump plate type, allowing to replace the screw pumps with top drive. The equipment has already been used at the East-Messoyakhskoye field, complicated by a large number of mechanical impurities.

On the prospects for increasing the resource of high-speed submersible pumps, the Ph.D. Smirnov Nikolay Ivanovich, leading researcher Institute of Machines Science them. A.A. Blagonravova of Russian Academy of Sciences.

Based on the results of the experiments, the speaker makes a number of conclusions that when the rotational speed is changed twice at the same flow rate, the impeller wear rate increased 2.6 times, the guide vanes 10.9 times. The value of the exponent at the flow rate of fluid with abrasive particles for powder materials is 2.5-3; for guide vanes, it is about 3.4. A change in consumption by half, ceteris paribus, does not lead to a significant difference in wear rate. Estimated change in the intensity of erosive wear of a pump stage of one standard size with a nominal diameter of 75 mm: in increasing the rotational speed from 2870 rpm to 10,000 rpm together with the exponent 3, the intensity will increase 42 times. The peripheral velocities are respectively 9.25 m/s and 11.3 m/s.

Round table

The final stage of the conference was the round table “Innovations in oil production”, which was attended by Oleg Pertsovsky (Skolkovo), Danila Shaposhnikov (venture fund Phystech Ventures), Konstantin Nadenenko (venture fund “Leader”), Nina Feodosiadi (Accelerator of the Ural Federal University), Andrei Kuznetsov (innovator).

Participants discussed the problems of venture funds, investment in new projects, as well possible solutions. Thus, D. Shaposhnikov identified the lack of investment funds as one of the main problems, explaining this by the reluctance of oil and gas companies to invest in new technologies, and by the strive to support only custom R&D, consequently leaving the technology inside the company. Most majors have their own corporate funds: Like BP, Total, etc. It is necessary to look at the experience of foreign colleagues – the speaker suggested, noting also that the pilot-industrial introductions take a long time because of bureaucratic delays. However, in recent years the situation has improved: oil and gas companies have begun to explore new technologies more actively.

A somewhat different point of view was voiced by K. Nadenenko, who believes that the key problem of sectoral investments is not that there is not enough money, but the lack of projects that can be brought to court by external investors. Currently, the venture capital fund "Leader" is launching a new project in collaboration with the Chinese managing company, the purpose of which is to invest the output of Russian technologies to the Chinese market.

The conference lasted for three days, during which the participants of the sessions discussed issues related to energy-saving and digital technologies, issues related to complicated operating conditions, and also held the twenty-first meeting of the expert council on mechanized oil production. More about this we will tell in the following numbers.